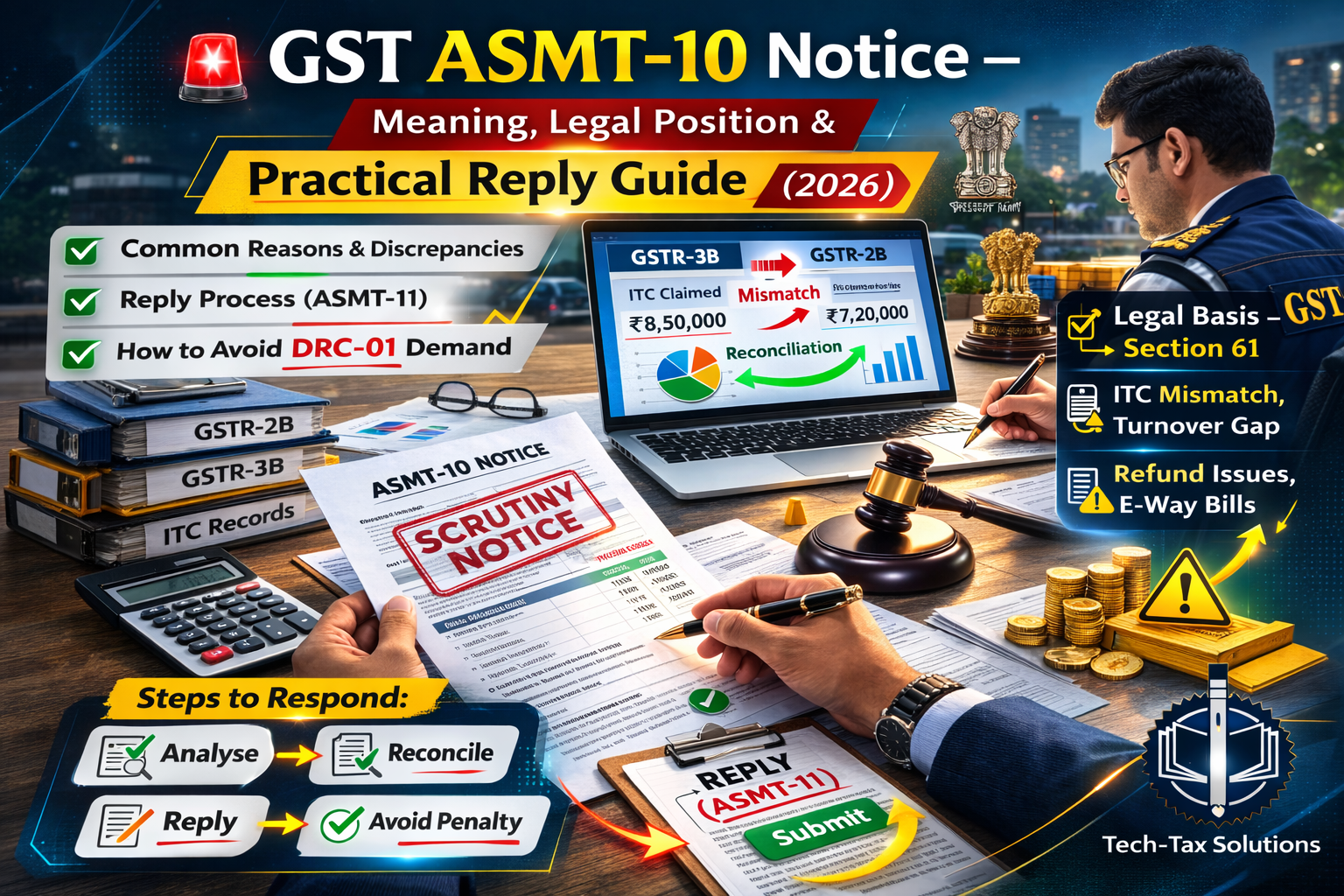

📌 What Is ASMT-10 Notice?

ASMT-10 is issued under:

Section 61 of the CGST Act, 2017 – Scrutiny of Returns

It is a pre-demand notice issued when the officer finds discrepancies in returns filed by a registered person.

It is NOT a demand order.

It is an opportunity to explain.

⚖️ Legal Framework – Section 61

Under Section 61:

-

Officer may scrutinize returns

-

If discrepancies found → Notice in ASMT-10

-

Taxpayer must reply in ASMT-11

-

Officer issues ASMT-12 (acceptance) if satisfied

If reply is not satisfactory, proceedings under Section 73 or 74 may follow.

🔍 Common Reasons for ASMT-10 Notice

1️⃣ ITC mismatch between GSTR-3B and GSTR-2B

2️⃣ Difference between GSTR-1 and GSTR-3B turnover

3️⃣ Excess ITC claimed

4️⃣ Late filing inconsistencies

5️⃣ Mismatch with e-way bill data

6️⃣ Refund inconsistencies

ASMT-10 is data-driven. Most cases arise from system analytics.

🧠 3 Practical Scenarios

🟢 Scenario 1: ITC Claimed Higher Than GSTR-2B

Officer alleges excess ITC.

Response Strategy:

-

Prepare vendor-wise reconciliation

-

Explain timing differences

-

Attach supporting documents

-

Clarify eligible ITC under Section 16

Many such mismatches are explainable.

🟢 Scenario 2: GSTR-1 vs GSTR-3B Turnover Difference

GSTR-1 shows ₹50 lakh, but GSTR-3B shows ₹48 lakh.

Possible Reasons:

-

Amendments

-

Credit notes

-

Reporting differences

Reply Strategy:

-

Provide reconciliation statement

-

Attach working

-

Explain adjustment entries

🟢 Scenario 3: Refund Claimed But Output Liability Shown Differently

Officer questions refund eligibility.

Response Strategy:

-

Provide calculation sheet

-

Link with zero-rated supply

-

Clarify tax payment trail

Structured reply prevents escalation.

📋 How to Reply to ASMT-10 (Step-by-Step)

Step 1: Analyse Discrepancy Carefully

Do not rush into reversal.

Step 2: Prepare Detailed Reconciliation

Attach working papers.

Step 3: Upload Reply in ASMT-11

Respond within prescribed time.

Step 4: Preserve Documentation

Maintain copy of submission.

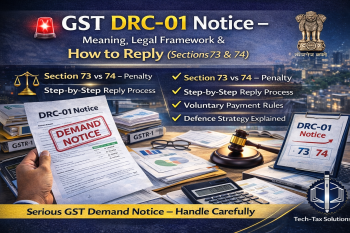

⚠️ What Happens If You Ignore ASMT-10?

If no reply is filed:

-

Officer may proceed under Section 73 (non-fraud)

-

Or Section 74 (fraud cases)

-

Demand notice in DRC-01 may be issued

Early reply avoids litigation.

❌ Common Mistakes Taxpayers Make

❌ Reversing ITC without legal analysis

❌ Giving casual one-line reply

❌ Ignoring reconciliation

❌ Missing response deadline

This converts a scrutiny notice into a demand dispute.

💰 Is There Any Penalty at ASMT-10 Stage?

No penalty at scrutiny stage.

However, if converted into demand under Section 73/74, interest and penalty may arise.

Hence, ASMT-10 is a preventive opportunity.

🏁 Final Takeaway

ASMT-10 is not a punishment — it is a compliance check.

Proper reconciliation and structured response at this stage can prevent demand proceedings and unnecessary litigation.

📞 Professional Advisory Note

Early professional review of ASMT-10 discrepancies significantly reduces risk of conversion into Section 73 or 74 demand notices.