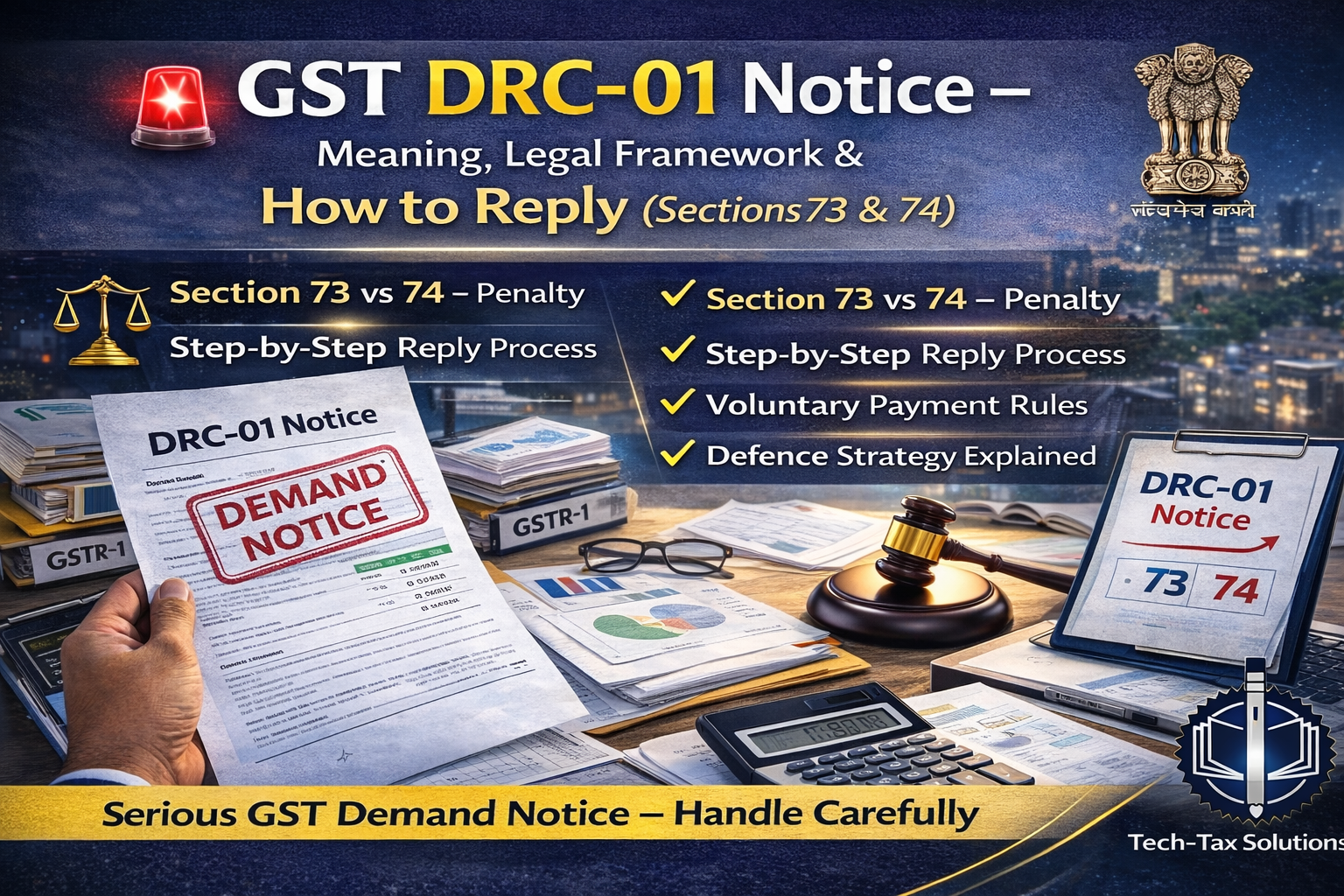

📌 What Is GST DRC-01 Notice?

FORM GST DRC-01 is a Show Cause Notice (SCN) issued under Section 73 or Section 74 of the CGST Act when the department believes that:

-

Tax has not been paid

-

Tax has been short paid

-

ITC has been wrongly availed or utilised

-

Refund has been wrongly granted

It initiates formal adjudication proceedings under GST law.

DRC-01 is issued pursuant to Rule 142 of the CGST Rules.

⚖ Legal Basis – Section 73 vs Section 74

| Particular | Section 73 | Section 74 |

|---|---|---|

| Nature | Non-fraud cases | Fraud / wilful misstatement / suppression |

| Intention required | No | Yes |

| Time limit for order | 3 years from due date of annual return | 5 years from due date of annual return |

| Maximum penalty | 10% of tax or ₹10,000 (whichever higher) | 100% of tax |

🔎 Important Safeguard – Section 75(2)

If fraud is not established, proceedings initiated under Section 74 may be deemed to be proceedings under Section 73.

This significantly reduces penalty exposure.

🔍 Common Reasons for DRC-01

DRC-01 may arise from:

-

Scrutiny under Section 61 (ASMT-10)

-

Audit under Section 65

-

Special Audit under Section 66

-

Investigation / inspection under Section 67

-

Data analytics mismatch

-

Intelligence inputs

Common triggers:

1️⃣ ITC mismatch (2B vs 3B)

2️⃣ Excess ITC claim

3️⃣ GSTR-1 vs 3B turnover difference

4️⃣ E-way bill discrepancies

5️⃣ Alleged fake supplier transactions

6️⃣ Refund irregularities

🧠 Practical Scenarios & Defence Approach

🟢 Scenario 1: ITC Not Reflecting in GSTR-2B

Allegation: Excess ITC of ₹10 lakh.

Legal Position:

-

ITC eligibility governed by Section 16(2).

-

Mere non-reflection in 2B does not automatically disallow ITC.

-

Conditions of Section 16(2)(a), (b), (c), (d) must be analysed.

Defence Strategy:

-

Vendor reconciliation

-

Proof of tax invoice

-

Proof of receipt of goods/services

-

Proof of payment to supplier

-

Commercial documentation trail

🟢 Scenario 2: Invocation of Section 74 (Suppression Alleged)

Officer invokes fraud.

Critical Review Points:

-

Is there evidence of wilful intent?

-

Is it interpretational dispute?

-

Is it clerical/technical error?

-

Is revenue neutral?

Improper invocation can be legally challenged.

🟢 Scenario 3: Turnover Difference Due to Credit Notes

Difference between GSTR-1 & 3B.

Legal Review:

-

Section 34 governs credit notes.

-

Timing and reporting reconciliation required.

-

Check Section 16(4) timelines.

Structured reconciliation often resolves dispute.

📋 How to Reply to DRC-01 (Step-by-Step Strategy)

Step 1: Analyse Allegations

Understand whether issue is factual or legal.

Step 2: Examine Invocation Section

Verify whether 73 or 74 is correctly invoked.

Step 3: Prepare Detailed Submission

Include:

-

Facts

-

Legal provisions

-

Circular references

-

Judicial precedents

-

Documentary evidence

Step 4: File Reply in FORM GST DRC-06

Step 5: Attend Personal Hearing

Mandatory if adverse order contemplated or requested (Section 75(4)).

💰 Voluntary Payment – Updated Legal Position

Under Section 73 (Non-fraud cases)

| Stage | Penalty |

|---|---|

| Before SCN | No penalty |

| Within 30 days of SCN | No penalty |

| After order | 10% or ₹10,000 |

Under Section 74 (Fraud cases)

| Stage | Penalty |

|---|---|

| Before SCN | 15% of tax |

| Within 30 days of SCN | 25% of tax |

| Within 30 days of order | 50% of tax |

| After that | 100% of tax |

Strategic decision required before opting for voluntary payment.

⚠ Common Mistakes in DRC-01 Cases

❌ Ignoring notice

❌ Paying full demand without legal review

❌ Not contesting incorrect Section 74 invocation

❌ Filing generic reply without documentation

❌ Missing personal hearing opportunity

🏁 Final Takeaway

DRC-01 is a critical stage in GST litigation.

However, demands can often be:

-

Reclassified from Section 74 to Section 73

-

Reduced substantially

-

Set aside on procedural grounds

-

Resolved through proper reconciliation

Early structured legal evaluation significantly reduces exposure.

📞 Professional Advisory Note

If you have received a DRC-01 under Section 73 or 74, conduct a detailed legal review of:

-

Limitation period

-

Nature of allegation

-

Availability of Section 75 safeguards

-

Voluntary payment implications

Before making any payment decision.