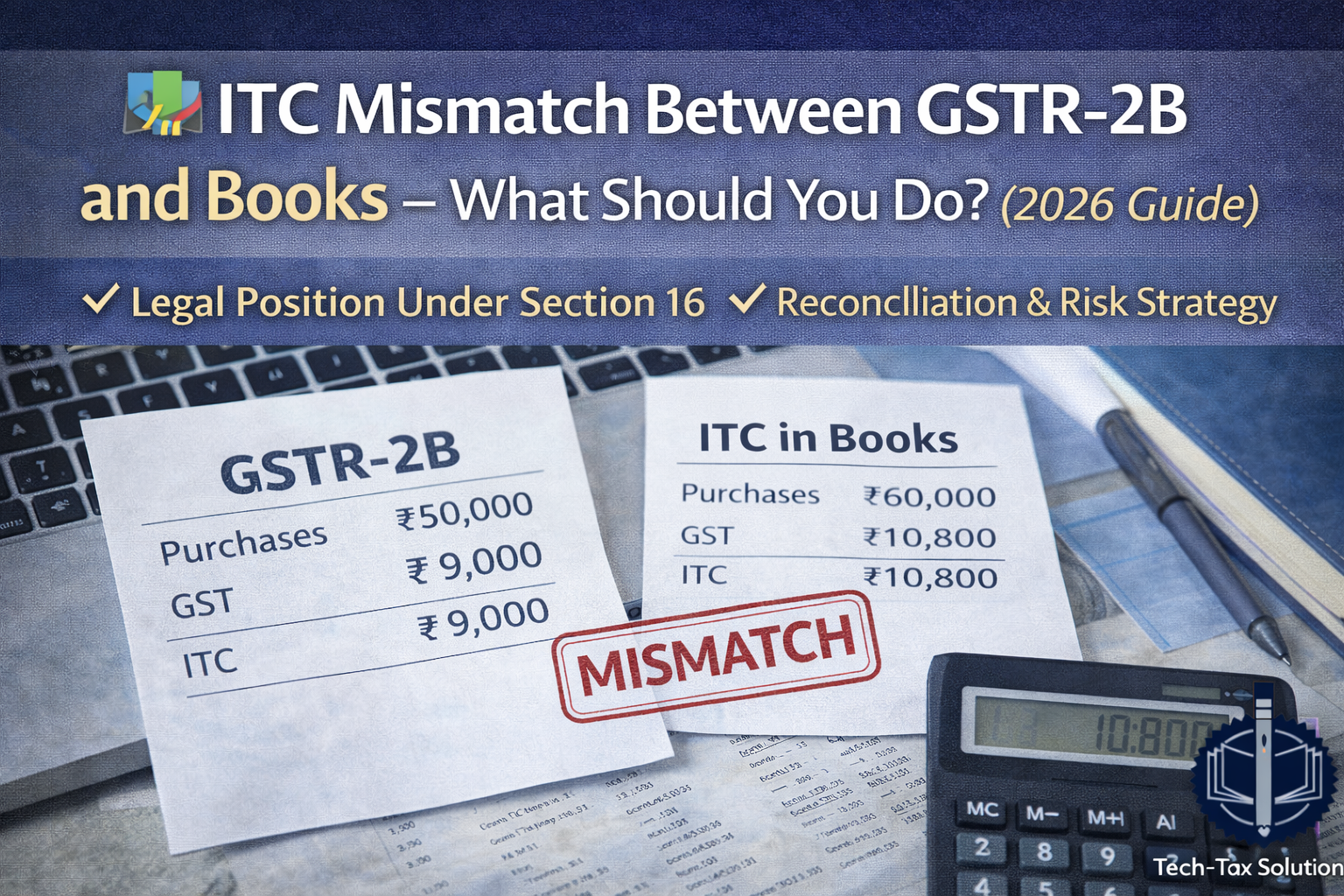

📌 Why ITC Mismatch Is a Serious Issue

One of the most common GST problems today is:

“ITC as per books does not match with GSTR-2B.”

This mismatch can lead to:

-

ASMT-10 scrutiny notice

-

DRC-01 demand notice

-

Interest under Section 50

-

ITC reversal pressure

Understanding the legal position is critical before taking action.

⚖️ Legal Position – Section 16 of CGST Act

As per Section 16(2) of the CGST Act, ITC is available only if:

✔ Tax invoice is available

✔ Goods/services received

✔ Tax paid by supplier

✔ Return filed

Further, Rule 36(4) and 2B mechanism link ITC eligibility with supplier reporting.

Hence, 2B reconciliation is now compliance necessity.

🔍 Common Reasons for 2B vs Books Mismatch

1️⃣ Supplier has not filed GSTR-1

2️⃣ Supplier filed but reported wrong GSTIN

3️⃣ Timing difference (invoice of March reflected in April 2B)

4️⃣ Debit/Credit note mismatch

5️⃣ ITC claimed on ineligible invoices

Not all mismatches mean ineligible credit.

🧠 3 Practical Scenarios

🟢 Scenario 1: Supplier Filed GSTR-1 Late

You purchased goods in March. Supplier files GSTR-1 in April.

Invoice appears in April 2B.

✔ ITC can be claimed in April return.

❌ No need to reverse permanently.

Timing difference must be understood.

🟢 Scenario 2: Supplier Not Filing Returns

Invoice in books but not appearing in 2B for months.

⚠ Risk: ITC may be disputed.

Practical Strategy:

-

Follow up with supplier

-

Maintain communication evidence

-

Evaluate vendor reliability

-

Consider commercial safeguards

🟢 Scenario 3: ITC Claimed on Blocked Credit

Invoice appears in 2B, but ITC is blocked under Section 17(5).

✔ 2B availability does NOT override eligibility conditions.

Example:

-

Motor vehicle purchase

-

Personal consumption

-

Construction-related expenses

Eligibility must be independently verified.

📋 Step-by-Step ITC Reconciliation Strategy

✔ Monthly reconciliation of purchase register with 2B

✔ Vendor-wise mismatch report

✔ Track aged unmatched invoices

✔ Review eligibility under Section 17(5)

✔ Maintain reconciliation working papers

Strong documentation prevents future disputes.

⚠ Common Mistakes Taxpayers Make

❌ Claiming ITC blindly because it appears in 2B

❌ Ignoring mismatch assuming “department will not notice”

❌ Reversing ITC without legal evaluation

❌ Not maintaining reconciliation evidence

These errors lead to unnecessary demand.

💰 Interest & Penalty Risk

If ITC is wrongly availed and utilised:

-

Interest under Section 50

-

Penalty under Section 73 or 74

Hence proper analysis is necessary before reversal or defence.

🏁 Final Takeaway

2B mismatch does not automatically mean ineligible ITC.

But ignoring mismatch is risky.

The correct approach is:

Reconcile → Analyse → Classify → Respond Strategically

📞 Professional Advisory Note

Regular ITC reconciliation and vendor compliance monitoring significantly reduces exposure to GST scrutiny and litigation.